Apollon Exit Scam: Analytical Market Review

Overview

On the 31st of January, members of the dark web community began warning users of the imminent exit scam of Apollon cryptomarket. Apollon Market, established in March 2018, has developed into a market with credible reputation in recent months as other key longtime markets have disappeared or been seized by authorities.

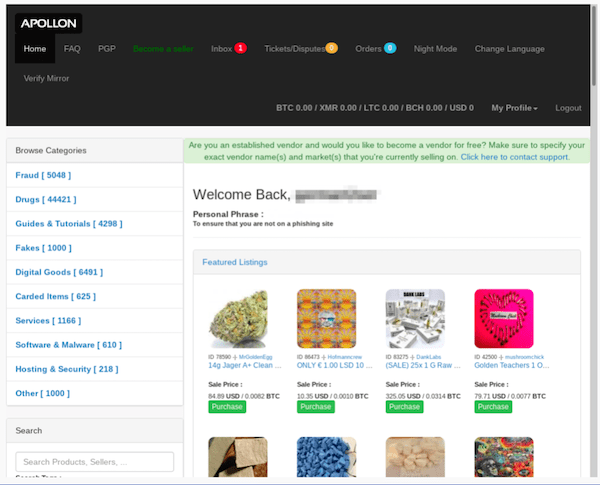

Landing Page for Apollon Market on Tor Browser Bundle After Login

After reviewing the archived market data captured by DarkOwl Vision, our analysts assess with high confidence that Apollon Market experienced a positively skewed distribution of activity driven by a surge of vendors appearing on the market in late 2019.

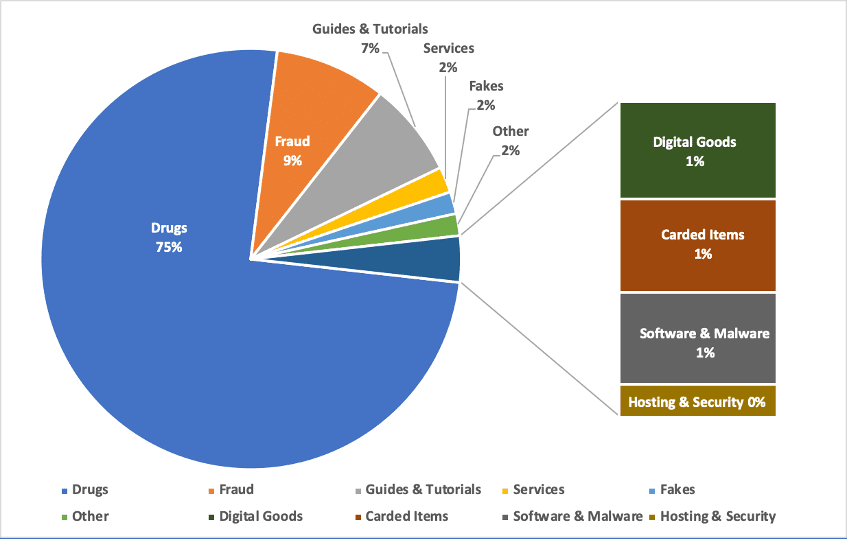

Total Listings per Category offered on Apollon Market as Defined by Market Administrators

This evidence suggests that law enforcement efforts to curb criminal behavior on dark web markets through heavy DDoS and subsequent seizure increase vendor sales for those vendors who are highly mobile across marketplaces.

Furthermore, addictive psychoactive stimulants, such as methamphetamine and cocaine, appeared frequently in not only the top number of listings sold and offered, but also in revenue. This suggests a substantial rise in popularity on the dark web marketplaces for these goods (as compared to Baravalle, Lopez and Lee’s Mining the Dark Web).

Apollon Market is largely a drug market with self-advertised market data from their landing page, suggesting that drugs comprise over 75% of the goods on offer. DarkOwl Analysts reviewed these to uncover that many of the advertised listings are duplicative and some categorized incorrectly.

Despite this, on average, there are significantly more drugs offered than digital goods, but some vendors observed considerable larger revenue and return on investment in the digital goods market segment.

Quantitative Findings

-

Since 2018, DarkOwl Vision archived 35,028 unique listings across 1761 vendor accounts on Apollon, comprised of a mixture of sales categories including drugs, digital goods, fraud, and malware.

-

DarkOwl analysts assess the total value of the market is $10,986,561 USD based on total sales reported and the value of the listings offered at the current exchange rate from Bitcoin (BTC) to USD or Monero (XMR) to USD.

-

The average revenue generated per vendor is $6,249 USD while the median revenue per vendor is $933.25 USD, suggesting that the distribution of the revenue across the market is heavily skewed, positively.

-

Despite this positive skew, there appears to be an outlying segment of particularly high-revenue vendors with much higher reported revenue than the rest of the vendors in the market.

-

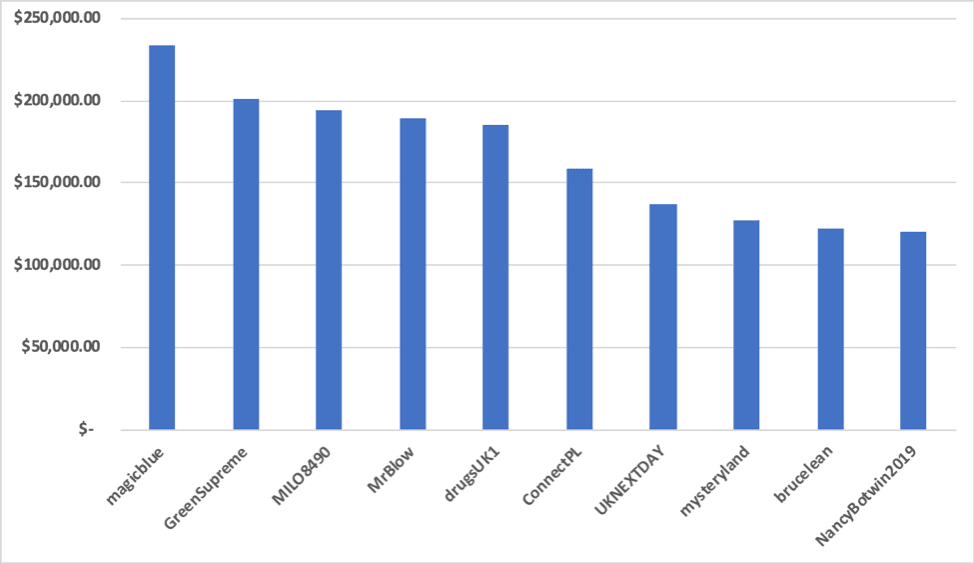

This is supported by the fact the top 10 vendors in sales revenue amassed an estimated $1.6 Million USD in total sales, while 14% of all vendors reported no sales at any point during their tenure on the market. Some non-active vendor accounts could easily be used for test purposes or as a law enforcement honey pot.

Countries of origin

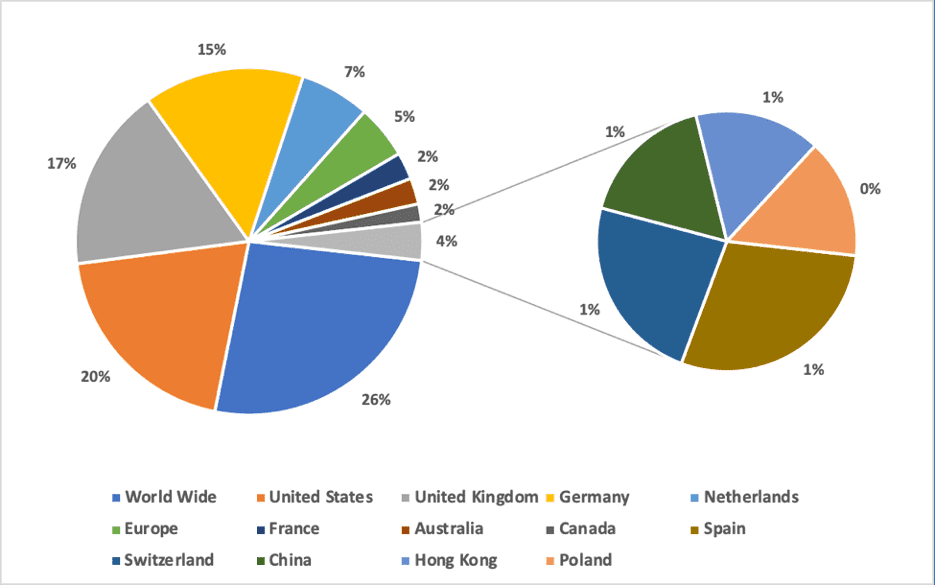

Vendor Advertisments by Country of Origin

Of the 35,028 unique listings, many do not specify the country of origin. Some merely state their location as “Worldwide,” suggesting that the vendor is potentially a network of suppliers around the world, the good can be delivered digitally, or the vendor is willing to assume the heightened risk of international shipping.

Of the 75% of listings that do provide a country of origin, 57% of the vendors claimed their goods or services originated within the USA, United Kingdom, Germany, and the Netherlands. 4.8% of them kept the country of origin generic as “Europe” and others specified generally unsuspecting locations such as the Pitcairn and Wallis and Futuna Islands in the South Pacific.

Listings

Drugs comprise the largest categorical segment of Apollon Market, with over 44,000 total listings, although some of these are duplicative [see Analyst’s Note below].

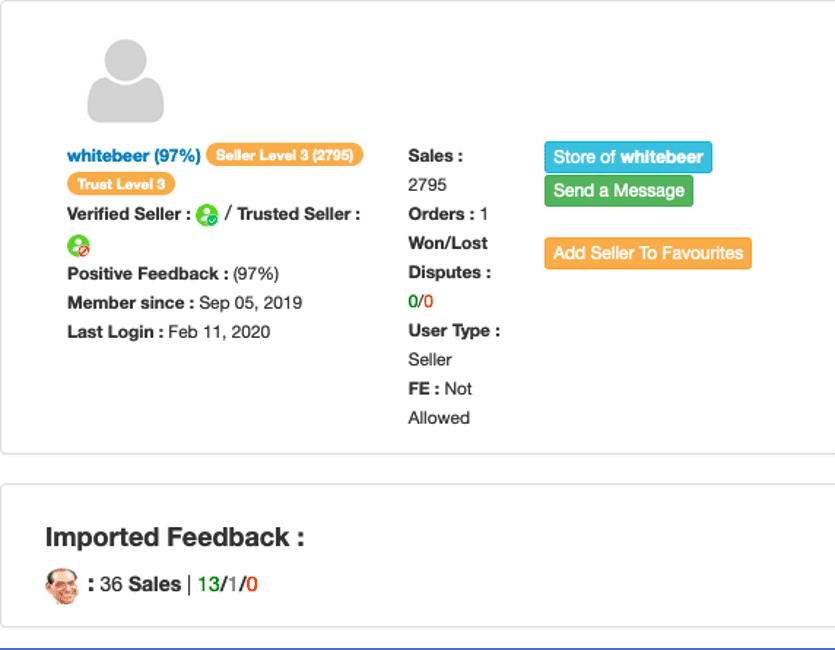

Of the drug listings, Cannabis, Stimulants, and Ecstasy comprise over 50% of those advertisements. A review of the total sales and revenue revealed that addictive, psychoactive stimulants were in the highest demand from this market, and the listing with the largest number of reported sales is Colombian Cocaine.

Based on current currency conversion rates for BTC to USD, the listing with the highest estimated revenue is a private “VIP” Digital Good offered by long-time dark web vendor, Gfellas, while the remaining 4 top revenue-generating listings were all drug related.

Analyst’s Note: Bear in mind that since the exit scam began, the market administration has been deactivating older listings, erroneously categorizing many advertisements across multiple categories, and manipulating vendor login data, prompting the need for a more rigorous review of the listing titles and descriptions using machine learning at a later time.

A Positively skewed distribution of revenue

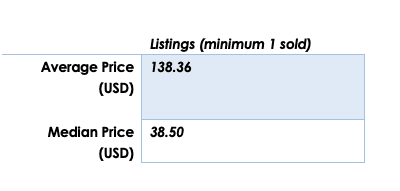

Analysis indicates that the average price for listings (with at least one sale) was anywhere from four to eight times the median listing price on Apollon. The observed distance between these grew with vendors with larger number of units reported sold.

Top Listings Sold and their Estimated Revenue

Apollon Market’s Evolution over Time

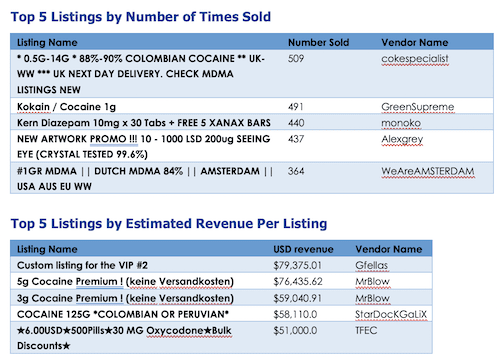

Spikes in Apollon vendor registrations following other major marketplace closures

In comparison to other dark web cryptomarkets’ longevity before exit scam or seizure, Apollon had a considerable run, trading for almost two years with minimal downtime. During the first few months, little activity occurred on the market, but the market showed considerable pickup in total number of vendors trading after other key markets went offline.

Market closures drive traffic

In July 2019, when Nightmare Market exit-scammed, DarkOwl observed that the total number of vendors on Apollon nearly doubled.

In October 2019, Berlusconi was seized by the Italian authorities, followed shortly by Cryptonia, which disappeared in late November 2019. After Berlusconi’s seizure, several vendors used their credibility from years of trading on those markets as imported feedback to drive a high volume of sales on Apollon.

Apollon experienced the largest number of new vendor registrations in December 2019, post Cryptonia, at 390 new vendors.

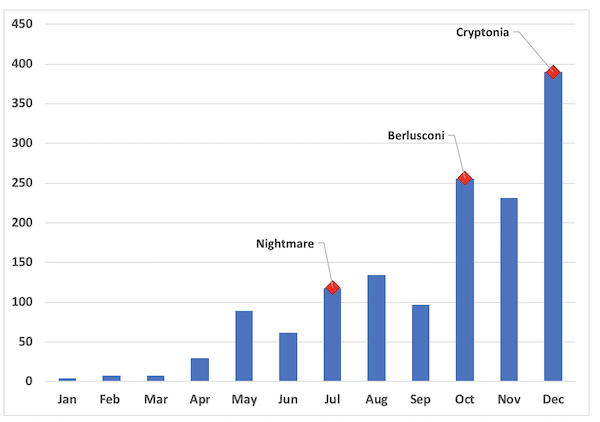

“whitebeer”

Vendor “whitebeer” showed to have a significant number of listings but also a considerable number of sales, appearing the top three of each list analyzed. Their total value of the sales though was only $48K, 21% of the revenue of the top vendor of the market in revenue, magicblue.

Key Vendors

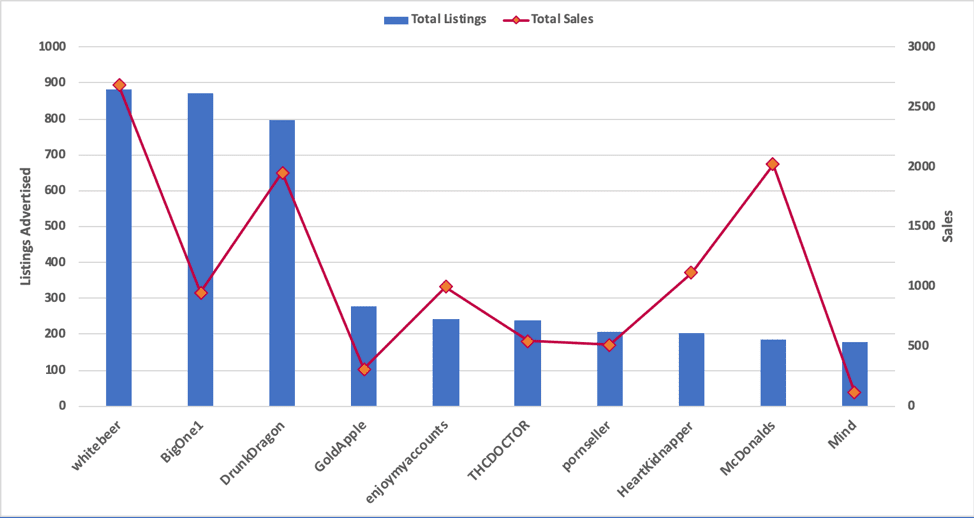

The top ten vendors by total number of listings along with their corresponding number of total sales are provided in the chart below. The top ten vendors in volume of offers does not link with those grossing the highest revenue nor having the highest total number of sales.

Top 10 Vendors on Apollon by Total Number of Listings

The top 3 vendors in revenue comprise 6% of all the revenue of Apollon Market while the top 10 vendors accumulated over $1.6 Million USD in total sales. The top vendors with the highest revenue trafficked drugs, suggesting that dealing in drugs yields higher gross income on dark web markets than digital goods or fraud services, such as fake passports.

Top 10 Vendors on Apollon According to Reported Market Revenue

The first market vendors

Despite the fact the market’s reported established date is March 2018, 45 vendors appeared on the market on 10 July 2018. DarkOwl assumes during the first three months, the market was likely in a testing phase and did not have any active trading occurring. Of those vendors appearing on 10 July 2018, the vendors with the largest total sales, were Dr.White3, g0ldenboy, HeinekenExpress, usagear, stanovo1ONLY, SUDO, and NUTSPRACKER; however, none of these vendors appear in the top 20 revenue-generating vendors list at the time we conducted analysis.

Vendors with the highest revenue

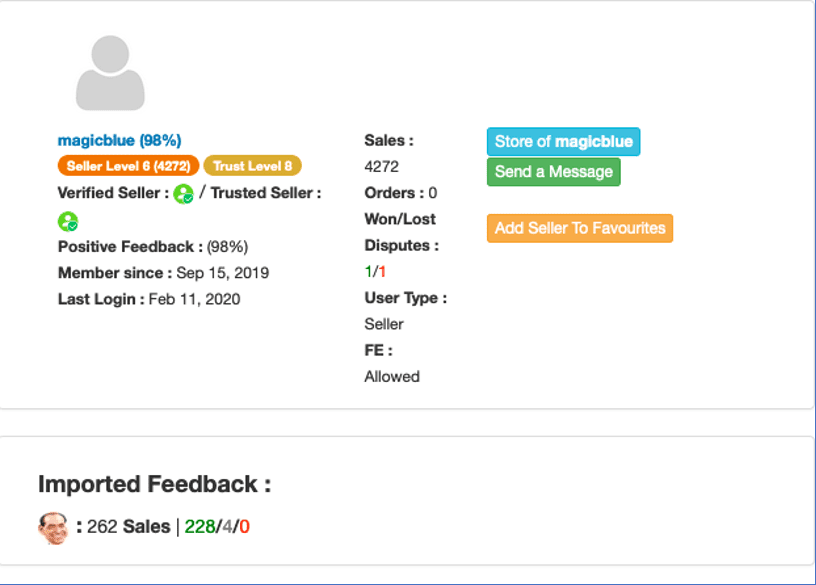

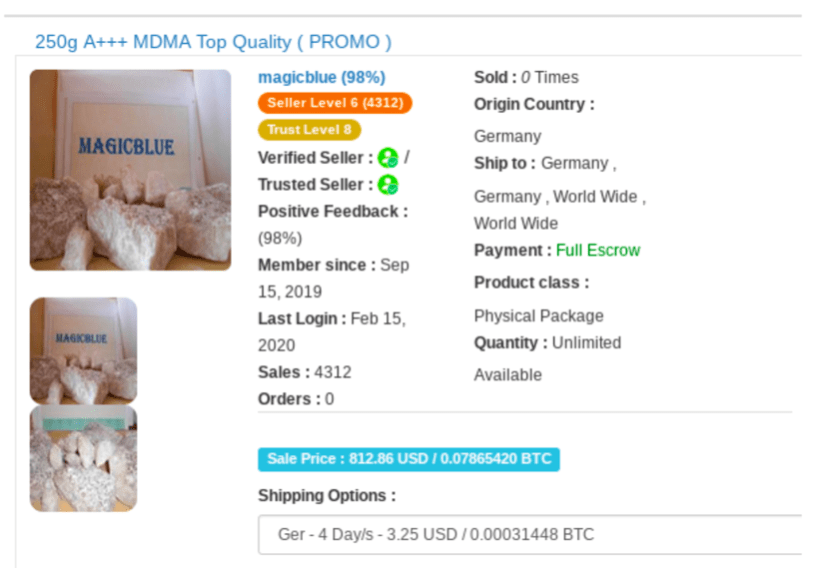

Based on historical market data and the current vendor profiles, the vendor using the moniker magicblue migrated over to Apollon in mid-September 2019, shortly before the announcement of Berlusconi’s seizure by Italian authorities. The vendor brought with them significant positive feedback and credibility from their years trading on Berlusconi. Shipping their orders from Germany, magicblue’s principle drug market is ecstasy and LSD. Their highest value listing on Apollon Market is 250g of A+++ MDMA “top quality” at $812 USD per order.

Vendor magicblue’s Apollon profile and MDMA Listing

Conclusion

DarkOwl Analysts’ analytical survey into Apollon Market yielded insight into the evolution of the cryptomarket in vendor registrations and listings, countries of origin and shipping, and general revenue generating activity. At time of writing, the market value is at $10.9 Million USD (based on an exchange rate of 1 BTC = $10,222.7 USD, the value at time of analysis) with addictive, psychoactive stimulants as the most popular, highest revenue generating category of drugs offered on the market.

Overall, Apollon Market is positively skewed distribution of revenue with the surge in vendor registrations and activity after Nightmare, Berlusconi, and Cryptonia disappeared either due to exit scam or market seizure. Vendors brought with them credibility and positive customer feedback and immediately began trafficking their goods and earning revenue. Like the Greek mythological Hydra, concerted efforts by law enforcement to remove drug trafficking on the dark web merely strengthens the resolve of the community and drug vendors continue to be highly mobile and attain uninterrupted success on emerging markets.

Explore the Products

See why DarkOwl is the Leader in Darknet Data

Products

Services

Use Cases